MSMEs are called the powerhouse of the Indian Economy. They contribute 27% to India’s GDP, provide over 11 crore jobs and contribute 45% to India’s exports. The 6.4 crore MSMEs embody the entrepreneurial spirit of India. But at the same time the MSME sector is often regarded as a symptom of India’s poor business environment, with 85% of all MSMEs classified as ‘dwarfs’ – older than 10 years and less than 100 employees, contributing very little to the overall economy. We have created a regulatory glass ceiling that prevents our entrepreneurs from focusing on growing their business. So, which of the two narratives is correct? Both are valid. We have a very large MSME eco-system, yet that ecosystem is struggling to grow and be dynamic because of challenges in scaling and business environment.

In this case, the two questions we need to answer when it comes to the Indian MSMEs are:

- How can we maximize the economic potential of MSMEs in sectors that are best suited for them?

- What changes are required to enable SMEs to break the regulatory glass ceiling and become large enterprises?

In this article, we will focus primarily on the first question where we try to understand how to unlock the economic potential of the MSME sector and maximize the Indian entrepreneurial spirit. The key to unleashing the economic potential of MSMEs lies in expanding their reach and enabling them to access previously untapped markets. By breaking down barriers and providing avenues for market entry, we can empower these enterprises to flourish and contribute significantly to the overall economy.

The second question has already been covered comprehensively by several economists – we must substantially reduce overall compliance burden along with greatly expanding the size thresholds where regulations kick in (read more in the Economic Survey of 2019 and in the report Jailed for Doing Business).

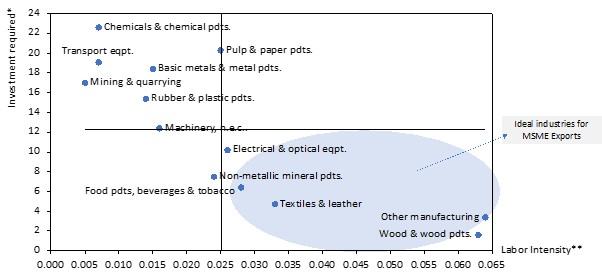

Industries that are best suited for MSMEs

Certain industries are a natural fit for MSMEs; industries dealing in wood products manufacturing, ayurveda and herbal supplements, handloom textiles, handicrafts, leather products, and jewellery, among others. They use traditional techniques of manufacturing and craftsmanship. These industries are distinguished by their high labour intensity and low investment requirements because of the use of handcrafted techniques. The high degree of product customization, India’s heritage value and use of handicraft being the key differentiation methods allows us to capitalize on the strengths of the Indian ecosystem. However, it is critical that we leverage these strengths for capturing international markets.

Why should MSMEs focus on exports?

Contrary to popular belief, for MSME-dominant industries, the domestic market size accounts for only ~2% of the global market size. While India has a large population, a significant proportion of it is still economically disadvantaged, and thus has limited purchasing power. This means that the effective size of the Indian market is small despite our large population. By making exports easier, we can allow our MSME entrepreneurs to tap into new markets and expand their customer base leading to increased revenue and profit potential.

Current Scenario for MSME exports

Today, less than 1% of Indian MSMEs export either goods or services with nearly 64% of them having an annual turnover of less than 1 Crore. SMEs often encounter various challenges like limited access to international markets, lack of market information, logistical complexities, financial constraints, and lack of economies of scale while exporting their products or services. However, the rise of e-commerce platforms has the potential to address these issues and provide significant benefits to MSMEs in their export endeavours.

Distribution of manufacturing industries in India

E-commerce exports is India is an underutilized channel

E-commerce platforms have already been enablers of exponential growth for homegrown B2C brands. They have allowed new age Indian brands to focus on the product while leveraging e-commerce technology and supply chains to service 300 million+ customers across the country. India’s e-commerce revolution has provided our artisans, traders, and home entrepreneurs a 24x7 marketplace where they can capture a slice of India’s USD 850 Bn retail market. It is now time for India’s entrepreneurs to build on this online retail experience and take brands from Bharat to the world.

In the past, it has been difficult for small firms to access export markets because of the inherent challenges that economies of scale represent – it is harder for small firms to access foreign markets, meet compliance requirements, produce cheaply, and manage logistics to clients. But the rise of broad and niche e-commerce marketplaces handles many of these barriers. If we modify our business environment to enable easy exports via e-commerce marketplaces, while at the same time taking care of a few fundamentals of ease of doing business, we can help our MSME sector radically transform itself into a growth engine.

India's current e-commerce exports stand at a modest USD 2 billion, accounting for a mere 0.5% of our total merchandise exports and only 0.25% of global B2C e-commerce exports. This minimal share in the global B2C e-commerce market can be primarily attributed to the lack of awareness and understanding regarding this export channel, as well as regulatory policies that do not adequately support the nature of business on e-commerce platforms.

Share of cross border e-commerce trade in total goods export (%, USD bn)

But projections indicate that by the end of the decade, e-commerce exports from India could expand to a remarkable size of USD 350 billion (one third of its total export), while the global B2C e-commerce market is expected to reach a staggering USD 8 trillion. These figures highlight the tremendous growth opportunities that lie ahead for India. Cross border e-commerce democratizes the global shopping landscape and enables MSMEs from Bharat to break the cross-border e-commerce trade cartel headed by Chinese brands.

So, what can India do to capitalise on this global e-retail opportunity? Where are the quick wins? And how can the Indian government help the Indian MSMEs establish global dominion?

Implementing a comprehensive e-commerce strategy that substantially facilitates aggregation and eases current bottlenecks is crucial to address the challenges faced by e-commerce exporters and boost MSME exports through this channel. While the recently released foreign trade policy 2023 talks about e-commerce exports, there is a need to identify a standalone strategy to maximize our e-commerce potential. The strategy will need to address a few key issues.

- Allowing separation of exporter from the product producer/owner which will allow aggregators to work more easily with small enterprises.

- Challenges in managing finances that arise as a result of foreign exchange and tax regulation, such as easier payment reconciliation norms, issues with GST refund, import duty on rejects, value limits on courier shipment etc.

The strategy will also need to identify other pathways for making it substantially easier for aggregators and marketplaces to set up and trade across borders. These changes will require a shift in mindsets – of treating Indian entrepreneurs with the assumption of trust. But doing this will be a game changer for MSME entrepreneurs from India.

Create a green channel clearance for e-commerce exports: Presently, there is no distinction between e-commerce exports and standard B2B exports from India. This leads to unnecessary time delays for shipments that are not as high value; it is estimated that ~4% of shipments are subject to delays at customs due to ad-hoc requests. We can reduce these regulatory delays by creating special customs supervision codes that distinguish e-commerce exports from other standard exports which help enable an expedited treatment of e-commerce exports at customs. This is already being done in China since 2014 and has been a key enabler in their e-commerce export success.

Have a single source of information: Today, there is no single credible platform that provides comprehensive insights into the entire exports process. Most platforms including India Xports only offer a brief outline of required documents with little to no detail. Given that India is emerging as a global leader in creating digital public goods, we can invest in creating a portal with a generative AI based chat bot that enables easy access to all relevant information. Ensuring that our entrepreneurs have the most relevant up-to-date information can eliminate the uncertainty involved with export compliance.

Facilitate rather than regulate: Currently, exporting from India is a taxing process; exporters need to comply with extensive documentation requirements related that are complex, time consuming and are changed frequently in an ad-hoc manner. Data from the World Bank Enterprise Survey shows that custom clearance in India takes ~2.5x longer than in China and Bangladesh. Any issue with documentation during customs clearance can result in shipment delays, resolving which requires physical presence at the customs office, which can take weeks to resolve. These regulatory and compliance issues along with the difficulty associated with accessing information related to merchandise exports deters entrepreneurs in India from exporting. Simplifying the export compliance process and improving information availability is key for enabling e-commerce exports.

Taking these four simple actions can unlock our e-commerce exports and enable MSMEs to actively contribute to India’s growth story.